How to Access Opay Loan in Nigeria Easily

Welcome to stepzee, in this post, you are going to learn how to get access opay loan in Nigeria and borrow money from opay, so if this sounds like a topic of interest to you, kindly stick around and read everything on this page, because you are not going to regret it.

Over the past few months, people has been asking questions like how to get loan in Nigeria, how do I get loan with ussd code, how do I get loan from okash and so on

That is why I am writing this post, to help those with these similar question solve their problem.

Getting a loan in Nigeria is something very difficult, I remember when I was trying to borrow loan to start a small business, I used different loan apps in Nigeria but none of them worked

And that time I didn’t know about opay loan, however, now that I know of opay and how to get loan from opay, I can easily collect loan anytime I like and repay later.

I also teach people how to make daily income without Investment, check it out here👉👉 Daily Bank Alerts

So without further ado, lets dive right into todays guide about opay loan.

Related: How to make money on opay refer and earn

How to start opay pos business

What is opay?

Opay is a payment wallet in Nigeria, users can send and receive money using the app, pay for food, pay for rides or even buy airtime from the app, opay users can also get cashbacks on their online purchases, users can also refer other people and earn money on opay.

The app is legit and has a 4.2 rating out of 5 on google play store, opay can act like your bank account, all you need to start using opay is a mobile number, you can use your mobile number to sign up for opay and that mobile number will serve like your bank account.

Can I get a loan from opay?

Yes of course, you can get a loan from opay, and the process is very easy to follow, all you need is to download the okash app on your phone, sign up using your mobile number, after signing up for okash app, open it and you can use it to request for loan up to 300,000 naira from opay, and after that, you will receive the loan amount and withdraw it to your Nigerian bank account.

For a more detailed guide on how to access opay loan in Nigeria, read through this post and you are going to see all the steps.

How to access opay loan

1. Download okash app

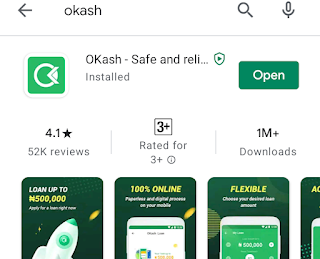

Before you can get access to opay loan, you first need to download the okash app on your phone, it is very easy to download okash app, if you are using android phone, just open your playstore app and search for “Okash”

The app has a green square logo, a white circle and a lesser than sign inside of the circle, the app also has 4.1 star rating on google play store which means it is very trusted, just click on install to start installing okash app on your android phone

And if you are using iphone, you can open your apple app store and search for okash, the app has a green and white logo as seen on the image above, click on install to start downloading the app on your phone.

2. Sign up for okash using the app

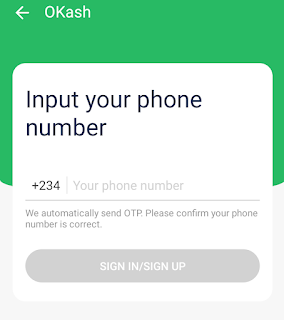

After downloading the okash app on your phone, you can then continue to sign up on the app, all you need to sign up for okash is a working mobile number

Now that you have the okash app on your phone, open it up, you will see “Input your phone number” enter your phone number without entering the first zero, after that click on sign up.

After clicking on “sign up” they will send an OTP to the phone number you entered, copy it and type it into the confirmation box

After doing that, you will be prompted to create a 4 digit password, this should be a very strong password, because you need to keep your account secured and hard for anyone to guess your password

Enter your 4 digit password twice and click on the “sign up” green button to continue to the next step

3. Apply for a loan

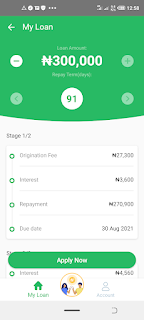

After a successful sign up on okash app, you now have access to opay loan, you can borrow as low as 3000 Naira and as high as 300,000 Naira. Below is how to request for loan on the opay app.

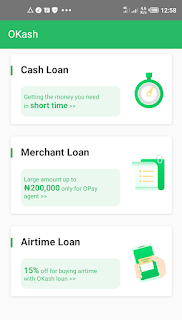

There are 3 different types of loan in the okash app, Cash loan, Merchant loan and Airtime loan respectively, so you are to choose from any of these to borrow from.

Select cash loan, a page will open where you can select the amount of money you want to borrow from opay, there is a plus and minus sign on the left and right side of the amount

Use the minus to decrease the amount and plus to increase it, after selecting your price, you should scroll down to see the details of the loan such as the interest, repayment amount and due date.

After seeing the information, scroll down a little bit and you choose the loan purpose, you can choose from the list, there are 6 loan purposes, daily consumption, medical cost, rent, business, education and others

Choose one and then click apply now, apply clicking on apply, you will have to agree to their terms and conditions,

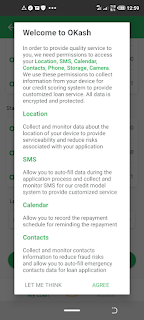

you will have to allow them to access your phone location, after reading through it, click on “Agree to continue”

Then they will ask you to fill in your personal information such as your name, gender, date of birth, BVN number, personal email address, street address and nearest bus stop. Fill it up and click submit.

And you are done, if you follow the above process carefully, you’ve successfully apply for opay loan, just wait for the loan amount to appear in your account.

4. Wait for the money to reflect in your account

After successfully applying for opay loan, kindly sit back and relax, the loan amount will reflect in your account, you need to be patient and don’t try to apply again because it may cause issues in your account.

After submitting your loan application, just relax, you can even go out and have fun while expecting a credit alert from opay. That’s it, if you have any questions on this, kindly leave it in the comment section below.

If you prefer a video format, kindly watch the below video to see how to access opay loan

How long does it take to get opay loan?

Getting opay loan can take up to 2 weeks, but if you are lucky enough, you may have the loan credited to your account within days, that is if you apply in a mid week, if you apply in a weekend, it may take longer, however, after applying for opay loan and getting approval, you will surely receive your loan in your account.

Opay loan is even faster than most loan apps in Nigeria, so after applying for opay loan, just relax, they will credit you.

Opay loan ussd code

The opay loan ussd code is *955#, this works on all networks in Nigeria, both MTN, Airtel, Glo and Etisalat will work, to continue to apply for opay loan using ussd code, kindly dial the code and continue with the process.

Opay loan app download

The opay loan app is called okash, and you can download it for your android phone or iphone, it is available on playstore and apple app store, you can download it for free and start applying for loans from the comfort of your home.

To download okash for your android phone, open your playstore app and search for okash, it has a green and white logo, just click on install to get started, and to download okash app for iphon, go to your apple app store and search for okash and start downloading it on your phone.

What is opay loan interest rate?

The interest rate for opay loan is dependent on the type of loan you apply for, if you apply for an annual loan, the interest rate is 36.5%, if you apply for, if you apply for daily loan, the interest rate is 1%, there are also some additional charges after this, this additional charge ranges between N1300 to N6000.

Final thoughts on how to access opay loan

Opay loan is a great choice if you are looking to get apply for loan in Nigeria, because it is fast and easy, all you need is your mobile number and your smartphone, people are applying for and getting loans from opay on a regular basis

So you too can apply and get the loan within a short period of time, however, taking loans can also be risky at times, especially if you want to use the money for a business and not sure if the business will make profits for you

So the advise is, you should make sure you can repay the loan before taking it, don’t, you can borrow small loans to solve little issues, but bigger loans should be avoided if you are unsure whether you can pay or not.

That’s all for today guys, I hope you get value out of this post, if you do, kindly help me share the post with others, and if you have any questions, please don’t forget to ask in the comment section below, I wish you all the best.

Nice one bro gonna apply this methodsRealwinner Tips

ReplyDeleteSure, and do let us know how it goes with you

Delete