How to Access Opay Loan in 10 Minutes (Okash loan) - Borrow loan on Opay

Hello, if you are looking for a quick loan, opay is a great choice if you are living in Nigeria, because, with opay, you can get a loan in under ten minutes.

In this article, I want to walk you through the process of getting a loan from opay fast, so if you want to know the complete process, make sure you follow me through the entire process.

I personally collected a loan on opay a few months ago, I discovered that many other people may be interested in this that’s why I decide to write this article today.

Now, without wasting any time, let's begin with the process.

Table of Contents:

- What is opay?

- Opay loan (Okash loan) requirements

- What is Opay loan (Okash loan) interest rate?

- How to borrow loan from opay

- How to repay Opay loan (Okash loan)

- Opay loan (Okash loan) frequently asked questions

What is opay?

Opay is a digital banking platform, it is the first cashback wallet in Nigeria and it is widely recognized in the Nigerian online banking system, also highly recognized by the CBN (Central Bank of Nigeria)

With some issues being faced by Nigerians in the banking sector, opay has helped a lot of individuals escape some issues related to banking

Even without having a BVN (Bank Verification Number) anyone can open an opay account and use it for daily transactions such as withdrawing money at the ATM, sending money to friends and family, or to a business partner.

Transactions on opay is easy and fast, even faster than many banks in Nigeria, so this has given opay the popularity it has as of this moment.

Opay loan (Okash loan) requirements

1. An opay account

You need to have an account with opay in the first place, but if you don’t have an account, you can learn how to open opay account here.

2. Few transactions

You also need to have carryout some transactions on the platform, you can't take a loan on opay with a brand new account, so after creating your account, use it for some transactions first, but if you are a regular opay user you can skip this step.

3. A valid identification document

When requesting a loan, opay will ask you to submit a means of identification, you can use your driver’s license, government-issued ID card or a voter's card.

Take note that without any of the aforementioned documents, you can't take a loan

4. BVN (bank verification number)

You will need to submit your BVN in order to take a loan from opay, this will help them better understand your banking behaviour before deciding whether or not they should give you the loan, if you are a regular bank user, then you shouldn’t worry because they will approve your request.

What is Opay loan (Okash loan) interest rate?

Opay loan interest rate is 36%, and it will be taken when you are repaying the loan which you borrowed from the platform, this is the interest rate for the whole year, which means it is about 0.1% daily interest. And if you can repay in less than a year, the interest rate will be smaller.

How to borrow loan from opay

You need to download the okash app, it is available on playstore, download the app and set up your account, setting up your account will take less than 10 minutes, but you must use the same mobile number you used on your opay account.

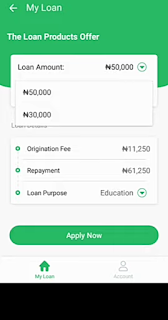

After setting up your account, open the app you will see loan option, click on it, and then you will appear on a page where you can request a loan, in the amount area, click the little drop-down icon, and you will see that the highest amount you can take is 50,000 Naira

You can take loan as low as 3000 Naira and as high as 50,000, you need to select your preferred amount, and then you will see the interest rate below.

If you are borrowing 50,000 Naira, the interest is 11,000 which means you will be repaying 61,000 Naira, make sure you read their terms and conditions before taking the loan.

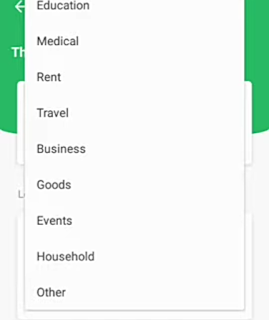

And then lastly, you will select the loan purpose, there is also a dropdown, click on it and select the loan purpose that best matches what you want to use the loan for, after that, click on apply now.

Immediately you click on “apply now” you will be asked to submit some of your basic information, such as your name, BVN, identity document etc.

Enter your correct details and click done, this will bring you back to the homepage, and you will see a message that says your loan is awaiting approval, when you see this message, just relax and wait for the loan amount to be credited to your account.

How to repay Opay loan (Okash loan)

- Open the opay loan app

- Login with your phone number and password

- Click "Loans"

- Click "Repay"

- Enter your pin and click "Confirm"

Opay loan (Okash loan) frequently asked questions

Is okash still giving loans?

As of the time of writing this post, Okash loan is still working, and all opay users can borrow money on the app, as long as you meet their requirements, you can request a loan anytime.

How much can I borrow from opay for the first time?

You can borrow anywhere from 3000 Naira to 50,000 Naira from opay loan, which you can pay back in 365 days or a shorter period.

How long does it take to get loan from opay?

After applying for a loan on opay, you will wait for their feedback, they usually respond to you in less than 24 hours, if your loan request is approved, you will receive a congratulations message, if not, you will receive the reasons to why your loan request was not approved.